If you’ve ever frozen up in front of a bank teller or stared blankly at a message from your banking app, you’re not alone. Financial English has its own set of banking terms, and it can sound like a foreign language even to native speakers. This guide breaks down the most useful banking vocabulary in clear, simple language. No finance degree needed.

Watch: Common English Phrases You’ll Need at the Bank

This short video shows what a real conversation at the bank sounds like. Great for anyone learning vocabulary and trying to feel more confident when talking about money.

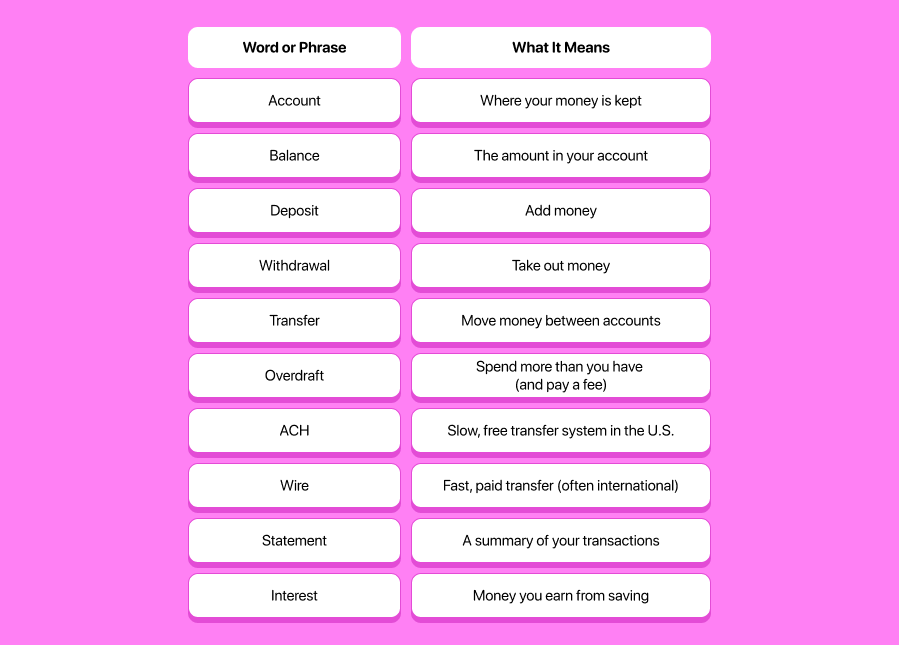

A Short Banking Words List You’ll Actually Use

Here’s a quick cheat sheet of useful banking terminology:

Talking About Accounts and Money

Let’s start with everyday situations: checking your balance, moving money, or opening an account. These are some of the most common banking vocabulary words you’ll hear:

- Account – where your money lives. You’ll usually hear checking account (for everyday spending) and savings account (to store money and earn a bit of interest).

- Balance – how much money is in your account right now.

- Deposit – when you put money into your account.

- Withdrawal – when you take money out.

- Transfer – moving money from one account to another (even between banks).

Example:

- “Hi, I’d like to transfer €200 from my checking to my savings.”

- “Can I get a printout of my balance?”

- “I need to make a cash withdrawal, please.”

Understanding Fees and Bank Charges

No one likes surprise charges. Banks have different types of fees depending on how you use your account, your card, or their services. Here are some of the most common ones to know:

- ATM fee – charged when you withdraw cash from an ATM that’s not owned by your bank. “There was a €3 ATM fee because I used a different bank’s machine.”

- Maintenance fee – a monthly charge just for keeping your account open. Some banks waive it if you meet conditions (like a minimum balance). “This account has a €10 maintenance fee unless I keep €1,000 or more in it.”

- Overdraft – when you spend more than what’s in your account. The bank lets the payment go through, but charges a fee or interest. “I went into overdraft by accident and got charged €25.”

- Foreign transaction fee – added when you use your card abroad or make purchases in a different currency. “There’s a 3% foreign transaction fee when I pay with this card overseas.”

- Early withdrawal penalty – a charge for taking money out of a savings product (like a CD) before its term ends. “If I touch the money before one year, there’s an early withdrawal penalty.”

- Wire transfer fee – a flat fee for sending money quickly through a wire transfer, especially internationally. “The bank charged me €20 for the international wire transfer.”

- Returned payment fee – charged when there’s not enough money in your account to complete a payment (like a bounced check or failed bill payment). “My bill didn’t go through, and I got a returned payment fee.”

How Banks Move Your Money: ACH, Wires, and More

When you send money, the bank uses different systems depending on where it’s going and how fast it needs to get there.

- ACH transfer – short for Automated Clearing House transfer. This is an electronic payment method used mostly in the U.S. It’s slow but usually free (takes 1–2 business days). Common for paychecks, rent, or utility bills.

- Wire transfer – a direct bank-to-bank transfer that arrives quickly (often the same day) but usually comes with a fee. It's used when money needs to move fast or go internationally, like for buying property or sending funds abroad.

Using Your Card and Mobile Banking

These days, a lot of banking happens on your phone or with your card. Here are some essential bank-related words in English you’ll see in apps and messages:

- Pending transaction – a card payment that hasn’t gone through yet. The money is “on hold.”

- Contactless payment – tap your card instead of inserting it.

- PIN – your personal code for using your card.

- Two-factor authentication (2FA) – an extra security step. For example, entering a code sent to your phone.

Example:

- “I see a charge that’s still pending. Will it go through today?”

- “I lost my card. Can I block it in the app?”

Saving, Earning, and Investing

When you're not just spending but growing your money, these terms are useful:

- Interest – extra money the bank pays you for keeping money in savings.

- Compound interest – interest that builds on top of previous interest. It helps your savings grow faster.

- CD (Certificate of Deposit) – you lock money in for a set time (like 1 year) and get a higher interest rate. You can’t take it out early without a penalty.

- Investment – putting money into something (like stocks or funds) hoping it grows over time.

Banking doesn’t have to be confusing. Learn a few words, practice some phrases. And don’t be afraid to ask your bank to explain something clearly. It’s your money, and now your English is ready to handle it.

FAQ: Banking Terms Made Simple

1. What does ACH stand for in banking terms?

ACH stands for Automated Clearing House. It’s a system used in the U.S. to move money electronically between banks. ACH transfers are usually used for things like direct deposits (your paycheck), bill payments, or rent. They’re safe and low-cost, but usually take 1–2 business days to process.

2. What is investment banking in simple terms?

Investment banking is a service for large businesses, not individual customers. It helps companies raise money by selling stocks or issuing bonds. It also advises businesses during big moves like mergers or acquisitions. In short, investment banks work behind the scenes on major financial deals, not the kind of place where you open a savings account.

3. What’s the difference between a checking and a savings account?

A checking account is for daily use: you pay bills, shop, and receive your salary there. A savings account is meant for storing money over time and usually earns some interest. Many people use both: checking for spending, and savings for future goals or emergencies.